Cryptocurrency IRAs

About Cryptocurrency IRAs

A cryptocurrency is a digital or virtual currency that is secured by cryptography, generally not issued by any central authority. Cryptocurrency is one of the many assets you can hold in a tax-advantaged CNB Custody Traditional or Roth IRA. We have the expertise and experience to guide you in establishing IRAs and to help you stay informed about your investing options.

Cryptocurrency Products Your IRA Can Own

At this time, CNB Custody is able to hold the following:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- USD Coin

Cryptocurrency Trading & Storage

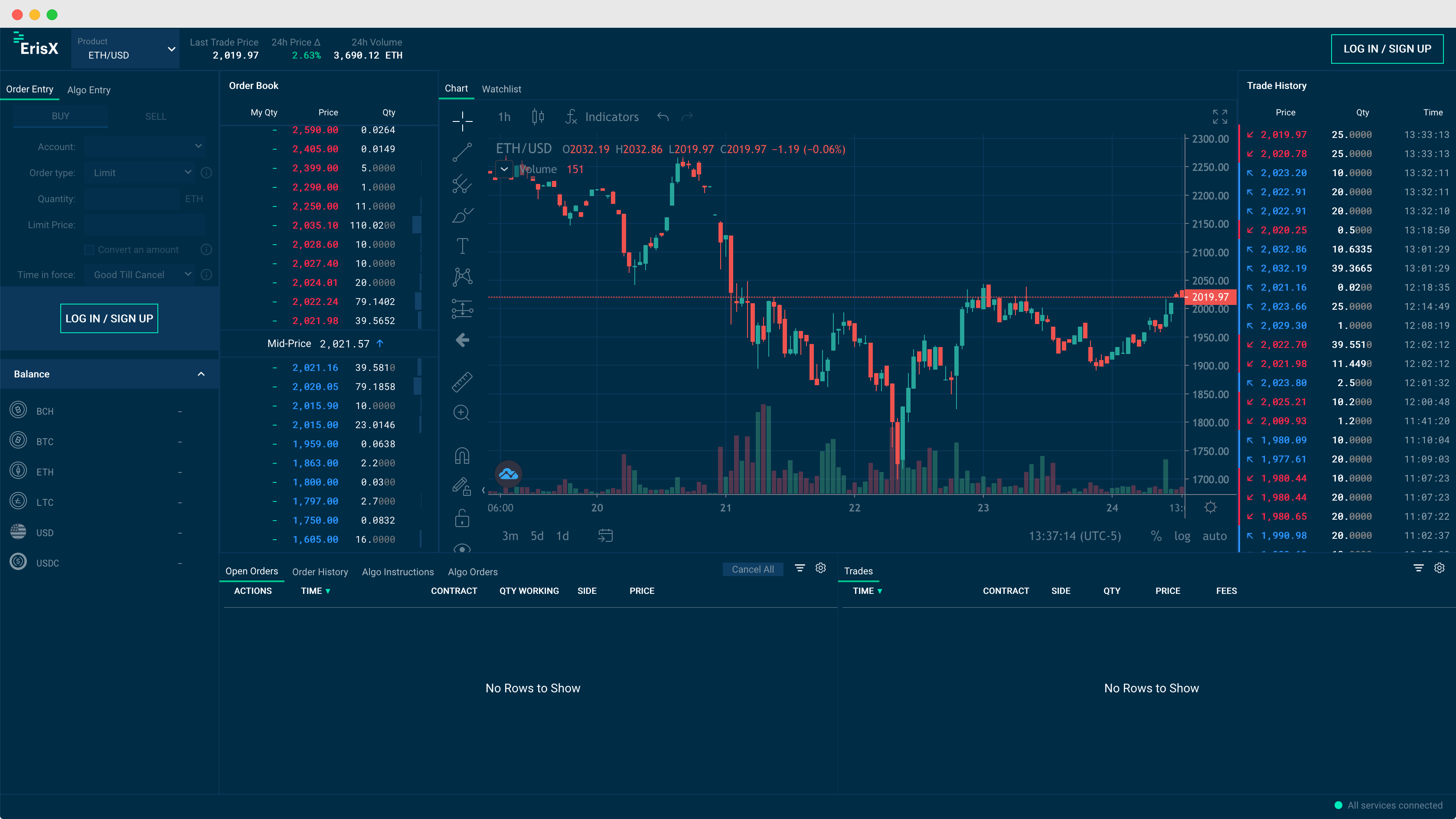

CNB Custody utilizes Cboe Digital Clearing for cryptocurrency trading, allowing account holders to trade crypto assets 24/7. Before opening a cryptocurrency account at CNB, be sure to review Cboe Digital product information and disclosures for consumers.

Wallet and Cryptocurrency Security and Storage. Cboe Digital has built a multiple signature (“multisig”) wallet architecture, requiring a majority of signing keys to validate all cryptocurrency transactions, which allows for secure interaction while maintaining fully independent control of cryptocurrency. Signing keys are protected through a variety of online and offline processes and tools, including hardware security modules (HSMs), air-gapped networks, multi-region availability, and “eternal quarantine” equipment that restrict access and control only to authorized personnel. These tools and processes ensure that digital asset transactions are intentional, accurate, and valid. Contact Cboe Digital for more information at Digital.info@cboe.com or (888) 782-7481.

How to get started

Our experienced staff will work closely with you by providing educational resources to assist you with the rules for IRA investing. CNB has the expertise to help guide you, answer any questions, and make the process easy. You can be assured that your calls and emails will be answered promptly and you’ll receive the attention you deserve every step of the way.

There are four ways you can fund your self-directed IRA:

Transfer funds from an IRA you have with another custodian.

Simply fill out our transfer request form to get started. Transfers do not prompt IRS reporting, taxes, or penalties because they are not considered taxable events.Rollover from another IRA custodian.

Your current custodian will send funds directly to you as account owner. You have 60 days from receipt of the funds to roll them over to another IRA and avoid taxes and penalties on the distribution. This is considered an indirect rollover and is reported to the IRS on Form 5498 since the initial transaction is a distribution. Only one indirect rollover is allowed per 12-month period.Rollover from a 401(k), 403(b), governmental 457(b) account, or other qualified plan.

These are considered direct rollovers and are not reported to the IRS. You will be required to contact your employer’s plan provider with instructions to begin the rollover. We will provide you with our rollover deposit statement.Contribution

Simply complete our contribution form and return it with the amount you would like to invest. Check with your tax advisor to be sure you are eligible for a contribution and the amount you are eligible to make. The standard contribution limit for 2021 is $6,000 or $7,000 if you are 50 or older

Complete the Cryptocurrency Account Funding Form.

Download the form here.

After notifying CNB you want to hold cryptocurrency in your IRA, you will receive an email from Cboe Digital containing a link to complete the establishment of your trading account. Follow the instructions in that email and review all fee and disclosure information carefully.

Once you have completed registration with Cboe Digital, CNB will fund the trading account from your IRA. After the funding arrives at Cboe Digital you will be able to log in to your Cboe Digital account using the password you established and begin buying and selling crypto assets!

Fees & Expenses

Cboe Digital charges 50 basis points (.5%) for each purchase and sale in an IRA account. Please refer to the Cboe Digital Fee Information for details.

CNB charges an $95 annual base fee per IRA and a $100 annual asset holding fee for cryptocurrency accounts. View the CNB fee schedule here for cryptocurrency account pricing.

Disclosures

Investing in digital currency is a new concept and remains very speculative, involving a high degree of risk. You are urged to seek professional guidance and/or consider proper diversification and risk tolerance before directing any investment activity. Community National Bank (CNB) does not recommend or evaluate the prudence, merit, viability, or suitability of any investment and will not be responsible for the performance of any investment product. CNB will provide custodial services with respect to the investments in your IRA, but we do not provide investment advice or information, nor are we the agent, partner, employee, representative, or affiliate of Cboe Digital, Cboe Digital Clearing LLC, Cboe Digital Exchange LLC, nor any financial representative, product sponsor, or other individual or entity except as otherwise disclosed. We are not responsible for and are not bound by any representations, warranties, statements, agreements, disclosures, advice, or information made by any such person beyond the terms and provisions contained in the CNB Custodial Agreement, Disclosure Statements, or other CNB forms or CNB documents.